E-mail: info@Swiftvs.com

E-Government

E-Government

Information Technology (IT) is recognized as an effective tool to facilitate the operation of government and the dissemination of government information and service. Swift has provided its expertise to governmental agencies in delivering good governance to their citizen, using cutting edge technologies. Swift e-Government solutions have the appropriate business, functional and technical requirements incorporated and they are backed-up by a high level of government domain experience.

Our offerings under e-government include:

- Financial Inclusion System

- Health Insurance Projects

- Public Distribution System (PDS)

- Smart Card based Driving License and Vehicle Registration

- Pilgrim Management System.

Advantage:

- Improved delivery of services to citizens.

- Empowerment of citizens through access to information.

- Greater transparency & Accountability.

- Improved security & convenience

Financial Inclusion

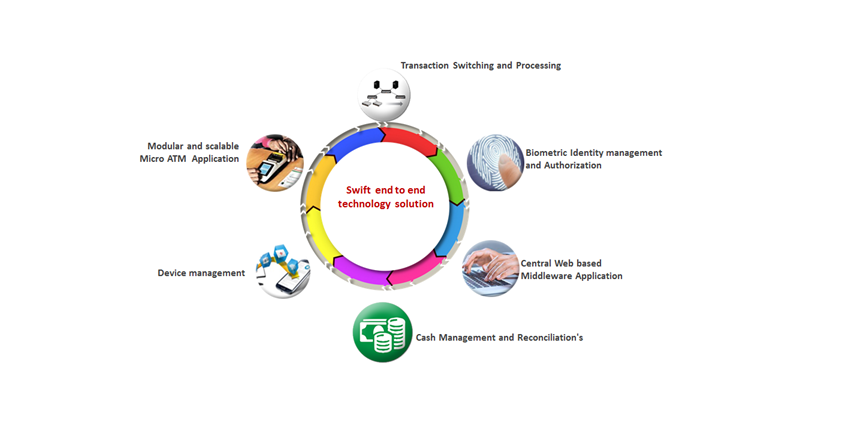

Swift established technology platform for executing Financial Inclusion Services at large scale. FI Solution is designed to support wide variety of devices (Mobile/Tablets/POS Terminals), Platforms and networks .Built on open Standards and proven technologies to provide true enterprise -grade extensibility and scalability. Financial Inclusion Technology Features:

In rural areas, major inconveniences for the poor in accessing banking services include the cost of traveling long distances & waiting in long queues. Technology plays an important role in achieving financial inclusion by allowing branchless banking at the doorstep of clients in remote/low population density areas.

Swift is forefront in providing cutting-edge banking technologies to the Banks & Institutions across India. Financial inclusion is not only providing the entire range of banking services, but also insuring that we provide opportunities for investment, insurance and pension products to every single Indian, no matter how small or how remote.

- Modular and scalable Micro ATM Application

- Transaction Switching and Processing

- Central Web based Middleware Application

- Biometric Identity management and Authorization

- Device management

- Cash Management and Reconciliation's

FI Products offered:

- Account Opening

- Bharat Bill Payment System (BBPS)

- Social Security System (APY, PMJJBY, PMSBY)

- Aadhaar Enabled Payment System (AePS-2.5)

- eKYC Enrollments

- Micro Insurance

- Third Party Deposit

- Self Help Group(SHG)

- Recurring Deposit

- Remittance

- RuPay Transactions

- Government Payments

RSBY

Rashtriya Swasthya Bima Yojana (RSBY) is a cashless health insurance scheme, launched by Ministry of Labour and Employment, Government of India to provide health insurance coverage for Below Poverty Line (BPL) families. Recognizing the diversity with regard to public health infrastructure, socioeconomic conditions and the administrative network, the health insurance scheme aims to facilitate launching of health insurance projects in all the districts of the States in a phased manner for BPL workers.

Swift is a leading solution provider for RSBY. Our solution enables large scale enrollment of beneficiaries by capturing their biometrics & photographs and issuing a biometric enabled smart card. All the hospitals empanelled under RSBY scheme are equipped with Transaction system. It allows Hospital staff to perform functions related to the provision of Health Insurance facilities to BPL citizens. Hospital Transaction System facilitates the beneficiary to get cashless treatment.

- Campaign for Enrollment activity with Nodal Agency in defined locations

- Enrolling the beneficiaries by capturing their photo & fingerprint

- Instant personalization and issuance of smart cards

- Dispatch of beneficiary details to server

- Data security- Backup, Loss/Leak prevention

- Training to

- Beneficiaries

- Health service providers

- Government staff / NGO’s

- Setting up of Help Line / Call center

- Campaign for Enrollment activity with Nodal Agency in defined locations

- Kiosk Maintenance

- Re-issuance of smart cards at district level on charge for

- Lost /damaged cards

- Splitting of cards

- Setting up of hospital equipment and software

- Establishment of hospital connectivity

- Backend transaction server setup including audit log and reporting

- Beneficiary uses his smart card to avail cashless medical services at the hospitals

ePDS

The Public Distribution System in India plagued with several malpractices which prevent the benefits from reaching the intended beneficiaries and also result in revenue loss for the Government. Swift solution provides Centralized Online Real-time Electronic PDS to improve efficiency & transparency in supplying commodities to the beneficiaries.

Public distribution solutions can take on a variety of formats, including mobile handheld terminals, self-service terminals, and temporary and permanent staffed facilities. Swift can support each of these approaches with an appropriate biometric authentication solution. Biometric systems for managing identities in public distribution systems have the potential to save costs, ensure goods and services reach the intended users and make the public program extremely accessible.

Our solution consists of Smart Card as Ration Card, an agent assisted portable teller machine for carrying out simple transactions in rural/urban environment, back end server software, enrollment software and MIS report generator. The system authenticates through live fingerprint (Biometric), and non-repudiation through transaction slip printouts. It also provides voice guidance in vernacular language to assist rural illiterate.

Solution Features:

- Biometric Smart Card acts as Ration card

- Beneficiary swipes the card & Terminal authenticates the customer using Biometrics

- Available balance commodity details are shown in the POS

- FPS personnel enters commodities being issued with card swiping

- Once commodities issued, quantities are deducted from balances

- SMS is given to the registered mobile

- FPS periodically replenished by the commodities sold in that period

Benefits of the System:

- Accurate and Real time information

- Eliminates PDS exploitation

- Paperless Operations

- Daily status of consumption and inventory of commodity

- Creates awareness among citizens on PDS/li>

- End to end monitoring on PDS leading to efficient consumption

Business Correspondent Services

Swift provides comprehensive Business Correspondent services to the underprivileged encompassing savings, credit, remittance, insurance, Mutual Funds and pension products in a cost effective manner, particularly in untapped / unbanked areas.

Lack of access to basic financial services is still a major challenge in India where majority of the population is classified as “Under Banked or Unbanked”.

The Business Correspondent model allows banks to provide door-step delivery of services especially ‘cash in – cash out’ transactions at a location much closer to the rural population, thus addressing the last-mile problem. BC Services:

- Opening of accounts using eKYC service

- AePS On-us transactions

- AePS off-us transactions

- Card with PIN Based On-us transactions

- Card with PIN Based Off-us transactions

- Opening of RD and TD Accounts

- Credit to GCC accounts

- Aadhaar/ Mobile/ PAN Seeding

- SHG Transactions with Dual Authentication system

- PMJBY Enrolments

- PMSBY Enrolments

- APY Enrolments & renewals

- Pension disbursement with AePS

- BC Login through Aadhaar Authentication Service

- Best Finger Detection Service

- Delivery and activation of RuPay cards

- BC management, monitoring and tracking of BC through dashboard

- Transaction reconciliation